Bitcoin fortunes regularly vanish when bitcoin holders pass away. Many millions of bitcoins are reported to be lost but how many of those are directly related to the lack of inheritance planning? Passing down bitcoin safely and privately to your loved ones is not a simple task. Having confidence in how you hold your own bitcoin keys is one thing to focus on but trusting that your heirs will safely receive your bitcoin holdings when you pass away is a very different task. Lack of privacy can also be a major issue.

There are too many stories of bitcoin holders disappearing with their stack at the time of their death. Should you consult a lawyer? Will they know how to help you? Can you really trust them or are you simply broadening your attack surface? What about multisignature or timelocks? Is that safe to use and will your heirs understand how to use them? How do you make sure that your heirs only have access to your funds after you pass away if you involve them in the inheritance planning early on? Should your heirs know in advance how much bitcoin you plan to pass them? Is bitcoin inheritance planning a legal or technical concern? Well, of course, kind of both. We’re only scratching the surface of inheritance planning and that is already quite a lot of open questions.

You can read multiple books and articles about bitcoin inheritance planning, and still not get concrete answers to your questions. Ultimately, inheritance planning is about passing down your bitcoin to your heirs with confidence. Technical concerns are often at the top of the list. How do you make sure that your heirs can access holdings with their keys or seed backup when they need it? The other set of questions is a legal one: how do you make sure that your heirs have the legal entitlement to your holdings after your death? While the latter is an important legal consideration, we will focus mostly on the former, which is dealing with technical considerations.

There are roughly three main ways of planning the inheritance for your bitcoin holdings, which cover both legal and technical considerations, taking into account sovereignty in custody.

- Custodial: Fully trust someone else to do it for you.

- Collaborative custody: Involve other trusted parties to help you partially.

- Self-custody: Only trust yourself with inheritance and no one else.

Custodial services

Using a custodian to hold your bitcoin is risky, and probably not a good idea. You only have paper bitcoin until you hold your own keys and receive the balance of bitcoin that the custodian owes you. Many popular custodians that failed over the years were found to be operating fractional reserves, treating their clients as unsecured creditors. In such a case, your heirs could get only a few sats per bitcoin in case of inheritance, or nothing.

If your custodian holds bitcoin in trust, it means that you have legal title but ownership rights may differ across jurisdictions. Custody risks are quite high. The technology stack of custodians is often closed source, and not openly verifiable, with insurance policies that cover pennies on the dollar in cases of theft and loss. That being said, if you trust a custodian (reminder, you shouldn’t), you “only” have to take into account the legal consideration of passing down your bitcoin.

Naming a beneficiary to your account would be required to make sure your heirs can have legal title on your holdings when you pass away. This option involves the least amount of technical considerations for your heirs as they would be dealing with the custodian directly to support them in receiving funds. While it may sound like a simple way to pass down bitcoin, it has severe drawbacks when it comes to sovereignty of your holdings as your heirs may be prevented from accessing the funds due to legalities. There may be additional fees to take into account, and bitcoin custodians often being foreign entities outside of your own jurisdiction, the settlement of funds may take quite some time as these procedures are not widely common these days.

The custodial option can be heavy on legal work as it resembles how traditional assets are passed down in inheritance procedures, but may be the least technical avenue. That does not mean this option is safe though it may sound the easiest and counterintuitively less intimidating at first.

Collaborative custody

There are a growing number of companies building inheritance protocols such as Unchained Capital or inheritance plans such as Casa to help their customers manage their bitcoin estate planning. Generally speaking, it involves multisignature where a user would collaboratively hold bitcoin keys with trusted entities that would act as recovery agents.

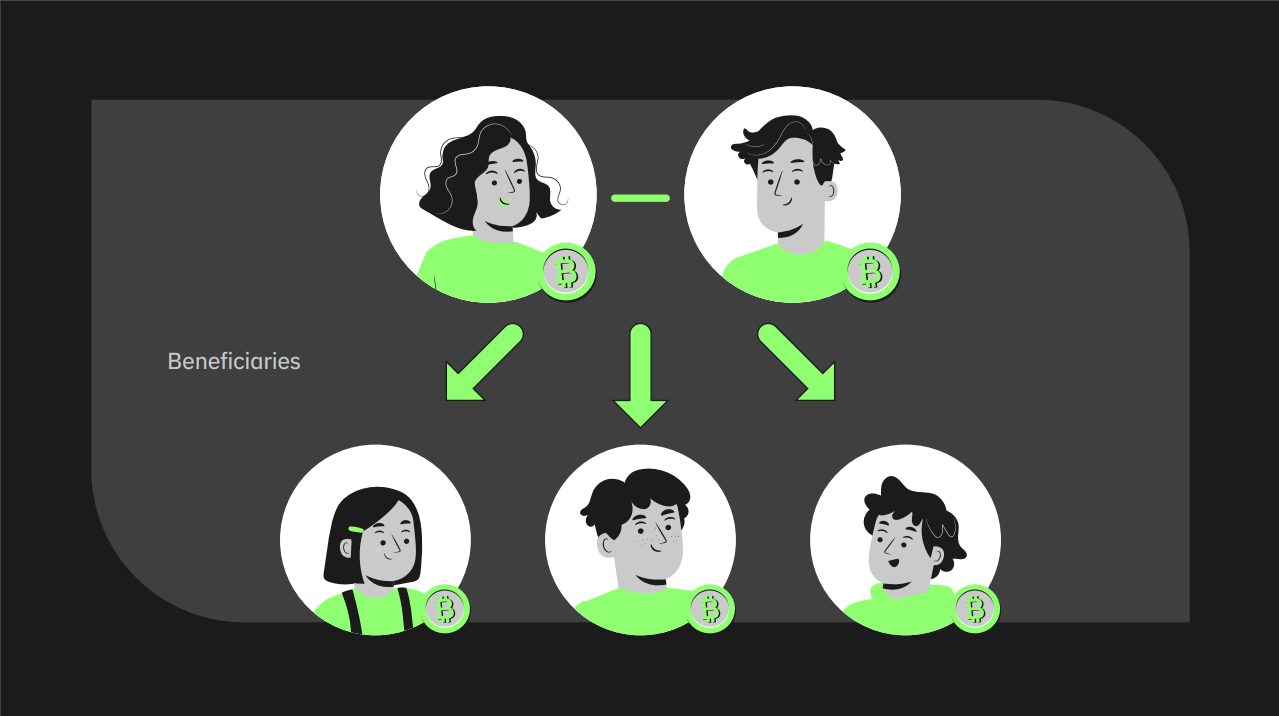

In a simple 2 of 3 multisignature, you could hold one key, give one key to your spouse and a third key to a service provider that would only be required to sign off on a transaction if you were to pass away. That simple setup would, of course, require that your spouse knows how to proceed when you pass away. It also requires trust that the service provider will still be available when you pass away (most likely in a long time from now), and that they do not prevent your spouse from accessing the funds by then. This alternative may also limit your ability to control your bitcoin while you’re alive and healthy as you would be required to co-sign transactions with your spouse or the service provider. All the procedures ought to be notarized so there are likely some legal concerns to be dealt with, which can increase the complexity of the setup.

Collaborative custody is obviously an improvement from using a fully custodial account to pass your bitcoin, but it has other drawbacks. Comprehensive documentation is required to make sure that all involved parties are fully aware of the technical implications in the recovery. How are funds planned to be recovered? Will bitcoin keys be used or only seed backups for recovery? Is the wallet configuration file (or descriptors) properly backed up by the recovery parties, including derivation paths, extended public keys and redeem scripts? In that scenario, there are more technical considerations, which require testing for security purposes. Risk of loss due to mistakes, external theft or internal collusion is non-negligible. Keys you pass to your heirs can be used to access funds before you pass away. This does not necessarily mean your heirs would deliberately try to steal from you, but mistakes happen. Your heir keys could also be stolen from them, which could then be used to swipe your wallet if enough keys are accessible. Your heirs could also decide to steal from you, unfortunately.

As a general rule, the more parties involved, the broader the attack surface, which means more risk. As more parties are involved, complexity grows, which is negatively correlated to the security of your stack. In other words, inviting other parties to hold bitcoin collaboratively does not necessarily mean more security for your inheritance planning. To mitigate these risks, regular key health checks are required to ensure everything works as intended for the unexpected event of you passing away.

100% self-custody

Some would argue that you should not trust anyone with your bitcoin, even in the case of inheritance planning. So how does one use bitcoin as a monetary computer network that is programmable without anyone’s permission and with full sovereignty? Securing and transferring your bitcoin holdings can be restricted to some conditions, such as multiple keys, thanks to multisignature, and specific times in the future, thanks to timelocks. As it was highlighted previously, sharing possession of keys in collaborative custody can lead to risks of your heirs being able to access your funds before they are meant to. Can timelocks fix this risk?

A timelock prevents your bitcoin holdings from being accessible to your heirs before a certain block height (absolute) or for a certain time when a UTXO is created (relative). As the primary owner of your bitcoin holdings, you can regularly update your wallet such that your funds are never at risk of being accessible before your death.

Using timelocks as a dead man’s switch is very powerful as it does not require any trusted third parties to be involved in the mix, and incentivizes you to do regular active checks on your bitcoin wallet, such as every 6 months for example. Before a timelock expires, you can renew it for another cycle or time period such that your funds are still protected by it. Early attempts at integrating this feature into wallets were recently announced by Nunchuk, as part of their inheritance plan, which involves a trusted server for delivering timelocks instead of the bitcoin native timelocks. Timelocks can be useful in the context of inheritance plans for your bitcoin, but are not convenient for day to day access of your holdings as they affect spending conditions for all keys in a wallet.

Bringing multisignature and timelocks together in a bitcoin inheritance plan can be powerful. Wallets using Miniscript to write wallet spending policies can substantially improve the user experience while optimizing for the safety of holdings to be passed down to your heirs. What would that look like? Adding conditions with distinct triggers to spend bitcoin such that your funds can either be spent with 2 keys out of 3 that you control, or with the third key and a timelock of one year. Everytime the timelock gets close to its expiration date, the funds can be swept to a new address with an updated timelock.

Recent implementations such as Liana by Wizardsardine are heading into that direction, allowing bitcoiners to benefit from novel options for bitcoin security, which should unlock new use cases for bitcoin inheritance planning without any trusted third parties. Privacy-first estate planning for bitcoin could be further improved by Taproot and its signature aggregation as wallets integrate state of the art bitcoin scripting features. Hardware device manufacturers such as Ledger are adding Miniscript capability to allow users to use wallets such as Liana in an air-gapped way.

Hybrid models could also be explored. A custodial account in the name of your heirs could receive the inheritance funds after your death as the timelock expires and decays a 2 of 3 multisig into a 1 of 3 multisig wallet where the key is managed by the custodian. Pre-signed transactions can also be used where your wallet funds would be swept into said custodial account. Of course, any time there is a new deposit, new transactions would have to be created and stored. These models are exploratory as multiple concerns have yet to be evaluated such as fee management, privacy tradeoffs and watch towers to prevent unexpected transactions from happening while you’re still alive and healthy.

Secure, offline, customizable, open-source, robust and fully sovereign bitcoin inheritance planning is getting closer every day. Not trusted third parties are required. While still in the early days of bitcoin inheritance products for consumers, it seems like there has never been a better time to evaluate different plans to pass down your bitcoin to your loved ones. No one likes to say it, but everyone dies unfortunately and so inheritance planning for bitcoin is a massive and untapped market ripe for improvements in the coming years. With Miniscript, major advancements in bitcoin script developer experience are possible, which opens up new options to build more sophisticated, yet correct, wallet policies. We will keep monitoring this space and try to add to this article as new products and services are announced.